Saturday 28December2013 - Dagwood's Take!

Thursday, 19 December 2013

Wednesday, 11 December 2013

Wednesday 11December2013 - Stock Market Trends - What Next??

Just some big picture perspective to consider.

Are the major stock market indexes now at a huge junction point within a huge 13 year Megaphone Market Top? If so, the next leg will be brutal to your equity market investments.

From Elliott Wave December Financial Forecast Issue.

Just some big picture perspective to consider.

Are the major stock market indexes now at a huge junction point within a huge 13 year Megaphone Market Top? If so, the next leg will be brutal to your equity market investments.

From Elliott Wave December Financial Forecast Issue.

Sunday, 17 November 2013

Sunday 17November2013 - Currency Moves!

Update from Jack Crooks at Blackswan Trading.

Expects the Canadian dollar to move lower vs the US dollar.

And the Euro to move lower vs the US dollar.

So my trade is to hold US dollars and use those US dollars to go short the Euro with EUO-NYSE.

Click to enlarge.

Update from Jack Crooks at Blackswan Trading.

Expects the Canadian dollar to move lower vs the US dollar.

And the Euro to move lower vs the US dollar.

So my trade is to hold US dollars and use those US dollars to go short the Euro with EUO-NYSE.

Click to enlarge.

Tuesday, 12 November 2013

Saturday, 9 November 2013

Saturday 09November2013 - Market Trends - What Next?

From World King News by Ron Rosen

"The general expectation is that if the Fed continues to do QE’s, the Stock averages will continue to move up. We know that gold is in a long-term bull market. The S&P 500 and the DJIA, if left on their own, would normally begin a leg E collapse at this time (see right hand side of chart below)."

Peter Grandich also believes the DJI average will peak in the 16,000 area and then start a huge E down leg in the megaphone bear market formation indicated in the following chart.

From World King News by Ron Rosen

"The general expectation is that if the Fed continues to do QE’s, the Stock averages will continue to move up. We know that gold is in a long-term bull market. The S&P 500 and the DJIA, if left on their own, would normally begin a leg E collapse at this time (see right hand side of chart below)."

Peter Grandich also believes the DJI average will peak in the 16,000 area and then start a huge E down leg in the megaphone bear market formation indicated in the following chart.

Thursday, 7 November 2013

Sunday, 4 August 2013

Sunday 04August2013 - Market Trends - What Next?

Danielle was a guest this past Saturday August 03 on Money Talks radio on the Corus network at 9AM PT speaking about recent trends in the world economy and markets. You can listen at this link to the CKNW audio vault in the archive here, by selecting Aug 3, 9am on the play bar.

Danielle was a guest this past Saturday August 03 on Money Talks radio on the Corus network at 9AM PT speaking about recent trends in the world economy and markets. You can listen at this link to the CKNW audio vault in the archive here, by selecting Aug 3, 9am on the play bar.

Sunday 04August2013 - REIT Market Action!

From Danielle Park's blog.

"We bought interest sensitive, dividend paying equities in 2003 and 2009, after they had crashed lower by 50%. After soaring above reasonable value over the past three years on QE, we see evidence to suggest that the third price mean reversion process since 2000, is now in progress. The below chart of the Canadian Real Estate Investment Trust ETF (XRE) demonstrates why it pays to respect the inevitability of mean reversion cycles. Those impatient or desperate for “yield” always make the same mistake, buying and holding at every price, they then lose years of income in a matter of weeks as share prices fall back below long-term averages. As shown below, REITS have so far lost 15% since May (nearly 3 years of income in just over 2 months) and counting. Around $15 today (from a high of nearly $18 in May), the 2003 and 2009 lows brought entry opportunities around $6.00 with income yields of more than 8%–a risk/return ratio worth waiting for again. By then of course, most of those holding today will be selling in horror after losing large chunks of their capital. They will then fire their broker or long-always manager and move to cash just as prices are finally attractive. And so the cycle goes…"

From Danielle Park's blog.

"We bought interest sensitive, dividend paying equities in 2003 and 2009, after they had crashed lower by 50%. After soaring above reasonable value over the past three years on QE, we see evidence to suggest that the third price mean reversion process since 2000, is now in progress. The below chart of the Canadian Real Estate Investment Trust ETF (XRE) demonstrates why it pays to respect the inevitability of mean reversion cycles. Those impatient or desperate for “yield” always make the same mistake, buying and holding at every price, they then lose years of income in a matter of weeks as share prices fall back below long-term averages. As shown below, REITS have so far lost 15% since May (nearly 3 years of income in just over 2 months) and counting. Around $15 today (from a high of nearly $18 in May), the 2003 and 2009 lows brought entry opportunities around $6.00 with income yields of more than 8%–a risk/return ratio worth waiting for again. By then of course, most of those holding today will be selling in horror after losing large chunks of their capital. They will then fire their broker or long-always manager and move to cash just as prices are finally attractive. And so the cycle goes…"

Sunday 04August2013 - Chart of the Day!

From Danielle Park's blog.

“Historically, regression to trend often means overshooting to the other side. The latest monthly average of daily closes is 67% above trend after having fallen only 11% below trend in March of 2009. Previous bottoms were considerably further below trend. Will the March 2009 bottom be different?”

From Danielle Park's blog.

“Historically, regression to trend often means overshooting to the other side. The latest monthly average of daily closes is 67% above trend after having fallen only 11% below trend in March of 2009. Previous bottoms were considerably further below trend. Will the March 2009 bottom be different?”

Saturday, 20 July 2013

Saturday 20July2013 - Opinion that Matters!

Link to Ambrose Evans-Pritchard's column in the London Telegraph re the mounting credit risk in China.

http://www.telegraph.co.uk/finance/comment/ambroseevans_pritchard/10186546/China-defies-IMF-on-mounting-credit-risk-and-need-for-urgent-reform.html

China defies IMF on mounting credit risk and need for urgent reform

If you think China's Communist Party fully understands the mess it has created by ramping credit to 200pc of GDP and running the greatest investment bubble know to man, read its shockingly complacent response to warnings from the International Monetary Fund.

Link to Ambrose Evans-Pritchard's column in the London Telegraph re the mounting credit risk in China.

http://www.telegraph.co.uk/finance/comment/ambroseevans_pritchard/10186546/China-defies-IMF-on-mounting-credit-risk-and-need-for-urgent-reform.html

Saturday 20July2013 - Opinion That Matters!

Ambrose Evans-Pritchard of the London Telegraph lays out the facts as he sees them at the following web link.

http://www.telegraph.co.uk/finance/comment/ambroseevans_pritchard/10172530/The-wheels-are-coming-off-the-whole-of-southern-Europe.html

The wheels are coming off the whole of southern Europe

Europe’s debt-crisis strategy is near collapse. The long-awaited recovery has failed to take wing. Debt ratios across southern Europe are rising at an accelerating pace. Political consent for extreme austerity is breaking down in almost every EMU crisis state. And now the US Federal Reserve has inflicted a full-blown credit shock for good measure.

Ambrose Evans-Pritchard of the London Telegraph lays out the facts as he sees them at the following web link.

http://www.telegraph.co.uk/finance/comment/ambroseevans_pritchard/10172530/The-wheels-are-coming-off-the-whole-of-southern-Europe.html

Monday, 24 June 2013

Monday 24June2013 - Stock Market Trends!

As the equity and bond markets enter the current major secular bear market, a number of the high flying sectors are now rolling over to the downside to joint those sectors that have already crashed.

Keep your powder dry for much better buying opportunities. However now is a good time to plan your shopping list and select the stocks and price targets so that when their prices get there, one has the presence and confidence to buy. Personally I'm interested in dividend paying stocks. So am selecting companies that have long term growth in both earnings and dividends. And some are just stable boring companies that do not have much growth potential but when dividend yields approach 10% offer excellent buys to hold for dividend income. Also looking at convertible debenture issues trading below par for my RRSP accounts that will provide excellent interest yields as well as capital gain as they return toward par at their maturity date.

The following chart from Danielle Park's Juggling Dynamite web site.

Click to enlarge.

As the equity and bond markets enter the current major secular bear market, a number of the high flying sectors are now rolling over to the downside to joint those sectors that have already crashed.

Keep your powder dry for much better buying opportunities. However now is a good time to plan your shopping list and select the stocks and price targets so that when their prices get there, one has the presence and confidence to buy. Personally I'm interested in dividend paying stocks. So am selecting companies that have long term growth in both earnings and dividends. And some are just stable boring companies that do not have much growth potential but when dividend yields approach 10% offer excellent buys to hold for dividend income. Also looking at convertible debenture issues trading below par for my RRSP accounts that will provide excellent interest yields as well as capital gain as they return toward par at their maturity date.

The following chart from Danielle Park's Juggling Dynamite web site.

Click to enlarge.

Thursday, 20 June 2013

Thursday 20June2013 - Ben Bernanke Driving In A Fog!

Link to Pimco Boss Bill Gross comments on Ben Bernanke's take on the economy.

Gross thinks Bernanke is driving in the fog.

http://www.bloomberg.com/video/gross-bernanke-s-message-was-pro-growth-sAAxHHrPS~SCBRcJiaRBvw.html

The following clip from Danielle Park's Juggling Dynamite web site.

Click image to enlarge.

Link to Pimco Boss Bill Gross comments on Ben Bernanke's take on the economy.

Gross thinks Bernanke is driving in the fog.

http://www.bloomberg.com/video/gross-bernanke-s-message-was-pro-growth-sAAxHHrPS~SCBRcJiaRBvw.html

The following clip from Danielle Park's Juggling Dynamite web site.

Click image to enlarge.

Monday, 17 June 2013

Monday 17June2013 - Danielle Park's Take!

The following clip is from Danielle Park's website "uggling Dynamite."

The following clip is from Danielle Park's website "uggling Dynamite."

All the Fed all the time

When the headlines are all about what the Federal Reserve will or won’t do this week, we can know for sure that today’s equity market is nothing to do with valuable investment opportunity and everything to do with unreasonable hype and hope. We continue to keep our eye on the foundation rather than the floral arrangements, and so far: global economy weakening, North American bond yields falling, commodities weaker, US dollar holding support, adviser sentiment supremely bullish, the most reckless behavior being touted as genius once more, margin (ab)use at all time high, S&P Shiller PE above 24, a near unanimous preponderance of buy and hold disciples — all confirming large downside destiny for over-valued stock prices.

Thursday, 23 May 2013

Thursday 23May2013 - The Debt Crisis!

The boomer generation continues to execute their "I'm all right Jack!" theme.

With no regard for the well being of the young generation coming up.

The message seems to be: So what if they are handcuffed to a huge debt not of their making. That's just the way the cookie crumbles..

The boomer generation continues to execute their "I'm all right Jack!" theme.

With no regard for the well being of the young generation coming up.

The message seems to be: So what if they are handcuffed to a huge debt not of their making. That's just the way the cookie crumbles..

Sunday, 19 May 2013

Sunday 19May2013 - Stock Market Action!

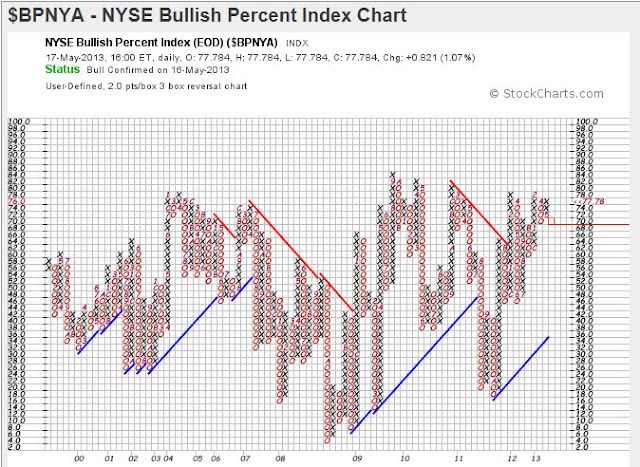

This past Thursday the NYSE Bullish Percent Index did a reversal to the upside which is a bullish for the US equity markets. However at the current 77.78% it is very close to highs reached over the past 13 years. So it is probably best to remain on the side lines for now. The run up in the SP500 has turned parabolic and a reversal to the downside could could be sharp and brutally fast.

This past Thursday the NYSE Bullish Percent Index did a reversal to the upside which is a bullish for the US equity markets. However at the current 77.78% it is very close to highs reached over the past 13 years. So it is probably best to remain on the side lines for now. The run up in the SP500 has turned parabolic and a reversal to the downside could could be sharp and brutally fast.

Wednesday, 15 May 2013

Wednesday 15May2013 - Currency Market Action!

It appears that the US dollar is ready to move higher against the currency index basket.

With todays close at 83.79 the US dollar has now broken above the 04Apr2013 83.49 and ready to challenge the July 2012 high at 84.10. Once it breaks above 84.10 the next target 88.70

Chart from Juggling Dynamite web site. Click to enlarge image.

As a Canadian I continue to trade this trend by being long the US dollar and short the Euro with EUO-NYSE (ProShares Ultra Short Euro ETF).

It appears that the US dollar is ready to move higher against the currency index basket.

With todays close at 83.79 the US dollar has now broken above the 04Apr2013 83.49 and ready to challenge the July 2012 high at 84.10. Once it breaks above 84.10 the next target 88.70

Chart from Juggling Dynamite web site. Click to enlarge image.

As a Canadian I continue to trade this trend by being long the US dollar and short the Euro with EUO-NYSE (ProShares Ultra Short Euro ETF).

Euro vs US dollar. Chart from EWI Short Term Update.

Click to enlarge.

Sunday, 21 April 2013

Sunday 21April2013 - The Trend Is Your Friend!

For those who think they can outsmart the market and in particular the junior resource stock market with its huge percentage swings where fortunes are made and lost, all I can say is Good Luck! As Jim Dines has repeated many hundreds of times "The Trend Is Your Friend."

So it is Very Important to be "On The Right Side of the Market."

Right now most junior resource stock gamblers have lost their shirts. Well actually most only have their socks still on. Every thing higher up has evaporated into thin air.

There will come a time when once again it will really pay Bigtime to BUY back into the junior resource sector including the precious metals in particular. But for NOW do NOT try to catch a falling 500 pound Safe. It's much heavier than you and will take you right down to the Bottom with it.

The chart below may help you get on the Right Side Of The Market. Wait until the technical signals are in your favour. A key indicator will be when downtrend lines break to the upside and the 20 Week Moving Average breaks Above the 40 Week Moving Average.

There is nothing wrong with being on the "Right Side Of The Market" and only making 100 to 200% on your trade over a couple of years. For me at least this makes more sense than trying to pick the bottom and that one stock out of 2000 that goes up 50 times. That's my 5 cents worth.

Click to Enlarge.

Don't know if this web link for the above chart works but will try to embed it in this post so that if interested you can view the updated chart on a regular basis.

http://stockcharts.com/h-sc/ui?s=$CDNX&p=W&yr=15&mn=0&dy=0&id=p45086283605&a=289939986&listNum=22

For those who think they can outsmart the market and in particular the junior resource stock market with its huge percentage swings where fortunes are made and lost, all I can say is Good Luck! As Jim Dines has repeated many hundreds of times "The Trend Is Your Friend."

So it is Very Important to be "On The Right Side of the Market."

Right now most junior resource stock gamblers have lost their shirts. Well actually most only have their socks still on. Every thing higher up has evaporated into thin air.

There will come a time when once again it will really pay Bigtime to BUY back into the junior resource sector including the precious metals in particular. But for NOW do NOT try to catch a falling 500 pound Safe. It's much heavier than you and will take you right down to the Bottom with it.

The chart below may help you get on the Right Side Of The Market. Wait until the technical signals are in your favour. A key indicator will be when downtrend lines break to the upside and the 20 Week Moving Average breaks Above the 40 Week Moving Average.

There is nothing wrong with being on the "Right Side Of The Market" and only making 100 to 200% on your trade over a couple of years. For me at least this makes more sense than trying to pick the bottom and that one stock out of 2000 that goes up 50 times. That's my 5 cents worth.

Click to Enlarge.

Don't know if this web link for the above chart works but will try to embed it in this post so that if interested you can view the updated chart on a regular basis.

http://stockcharts.com/h-sc/ui?s=$CDNX&p=W&yr=15&mn=0&dy=0&id=p45086283605&a=289939986&listNum=22

Thursday, 18 April 2013

Thursday 18April2013 - Changing Perceptions!

This from Danielle Park's website today.

The Bottom Line:

If the Big Bear Market is On the Radar,

Then, Rasie Cash and be Ready to Pluck some Bargains when the Financials, Utilities Sectors also plunge as FEAR takes Hold and Panicked Investors Sell at Any Price. Then We Have Bargain Days to Cherry Pick the Best Dividend Paying Stocks with Growth Potential.

Cyclical sectors like gold companies (XGD below) and many commodities are now in cyclical bear market territory (down more than 20% from their highs), but the interest sensitives (like financials, REITS and utilities) still have considerable downside potential in this cycle. Unfortunately for guaranteed deposit-refugees who have run to “defensive” stocks looking for yield, bear market selling cycles generally spread across the sectors before they complete. With the 2009 cycle lows a potential test, the next few months could offer great opportunity. But only for those who can first avoid significant capital losses.

Click Chart Image to Enlarge.

This from Danielle Park's website today.

The Bottom Line:

If the Big Bear Market is On the Radar,

Then, Rasie Cash and be Ready to Pluck some Bargains when the Financials, Utilities Sectors also plunge as FEAR takes Hold and Panicked Investors Sell at Any Price. Then We Have Bargain Days to Cherry Pick the Best Dividend Paying Stocks with Growth Potential.

Cyclical update

Click Chart Image to Enlarge.

Thursday 18April2013 - Euro Currency Comments!

From Blackswan Capital 16April2013 Monthly Newsletter.

"Italy and next-door Slovenia are rapidly coming up the radar screen as the most vulnerable to depositor flight. The Italian situation is further aggravated by the ongoing political struggle for power where two of the three major power contestants – Berlusconi and Beppe Grillo – are accumulating voter support by threatening exit from the Eurozone. The calls for Italy to exit the

Euro will gain more credibility if events in Cyprus and Greece proceed as expected.

A run on Italian banks will have major impact on French banking and, through the channel of French banks, on Belgian banking as well. French banks have an Italian exposure of €334 billion and an overall exposure to all Eurozone crisis countries of €778 billion.

Of the Eurozone banks’ total balance sheet of almost €33 trillion, roughly €11 trillion or one-third are bonds issued by banks and deposits owed to banks themselves. So whenever any single bank’s ‘shareholders, bondholders and uninsured depositors’ are expropriated, the event instantly ratchets down the solvency of every other bank, because those ‘shareholders, bondholders and uninsured depositors’ are these other banks," writes Leto Research. We don’t believe another crisis can be avoided given the global economic backdrop and the still massive structural problems still facing the Eurozone."

As a Canadian I am long the US Dollar (IE Holding US$ Deposits in Accounts) and short the Euro vs the US dollar with the ProShares Ultra Short Euro which trades as EUO-NYSE.

Click image to View.

From Blackswan Capital 16April2013 Monthly Newsletter.

"Italy and next-door Slovenia are rapidly coming up the radar screen as the most vulnerable to depositor flight. The Italian situation is further aggravated by the ongoing political struggle for power where two of the three major power contestants – Berlusconi and Beppe Grillo – are accumulating voter support by threatening exit from the Eurozone. The calls for Italy to exit the

Euro will gain more credibility if events in Cyprus and Greece proceed as expected.

A run on Italian banks will have major impact on French banking and, through the channel of French banks, on Belgian banking as well. French banks have an Italian exposure of €334 billion and an overall exposure to all Eurozone crisis countries of €778 billion.

Of the Eurozone banks’ total balance sheet of almost €33 trillion, roughly €11 trillion or one-third are bonds issued by banks and deposits owed to banks themselves. So whenever any single bank’s ‘shareholders, bondholders and uninsured depositors’ are expropriated, the event instantly ratchets down the solvency of every other bank, because those ‘shareholders, bondholders and uninsured depositors’ are these other banks," writes Leto Research. We don’t believe another crisis can be avoided given the global economic backdrop and the still massive structural problems still facing the Eurozone."

As a Canadian I am long the US Dollar (IE Holding US$ Deposits in Accounts) and short the Euro vs the US dollar with the ProShares Ultra Short Euro which trades as EUO-NYSE.

Click image to View.

Wednesday, 17 April 2013

Wednesday 17April2013 - Stock Market Trends - What Next?

One of the key technical indicators I watch is the NYSE Bullish Percent Index.

Yesterday (Tuesday 16April) we had a reversal to the downside. This means that more and more stocks in the 2000+ NYSE Company Listings are breaking their price uptrends and moving lower.

For the short term at a minimun we will most likey have declining stock market index values.

Trends are much easier to recognize with the following chart which is referred as a "Point and Figure" chart. This simple chart is actually covering trend changes in the SP500 for the past 13 years.

Recent History:

09Nov2012 - Down column of O's signalling most likely a drop in the SP500 then at 1377. For those so inclined to trade, one would go short the SP500 index with SDS or SH.

20Dec2012 - Quick Reversal to an UP Column of X's. SP500 at 1430. A clear signal to close your short position at a loss. This is a simple fact of trading. Close your losing positions. And for those who trade the Index go long SP500 Index ETF's. Personally I hold cash as I am already long the market with long term equity holdings.

16Apr2013 - Down column of O's signalling most likely a drop in the SP500 then at 1574. For those who went long the SP500 from the 20Dec2012 signal the trade generated a 10% return or more if leveraged with a 2X ETF such as RSU.

So the current NYSE Bullish Percent Index Chart signal is to go SHORT the SP500 Index. My trading stock to do this is SDS (ProShares SP500 2X Short) on the NYSE.

Currently I own this ETF and also own EUO which is a 2X short the EURO vs the US Dollar.

Remember these are short term trading positions and need to be closed to cut losses if the trade is not working.

Click to enlarge

One of the key technical indicators I watch is the NYSE Bullish Percent Index.

Yesterday (Tuesday 16April) we had a reversal to the downside. This means that more and more stocks in the 2000+ NYSE Company Listings are breaking their price uptrends and moving lower.

For the short term at a minimun we will most likey have declining stock market index values.

Trends are much easier to recognize with the following chart which is referred as a "Point and Figure" chart. This simple chart is actually covering trend changes in the SP500 for the past 13 years.

Recent History:

09Nov2012 - Down column of O's signalling most likely a drop in the SP500 then at 1377. For those so inclined to trade, one would go short the SP500 index with SDS or SH.

20Dec2012 - Quick Reversal to an UP Column of X's. SP500 at 1430. A clear signal to close your short position at a loss. This is a simple fact of trading. Close your losing positions. And for those who trade the Index go long SP500 Index ETF's. Personally I hold cash as I am already long the market with long term equity holdings.

16Apr2013 - Down column of O's signalling most likely a drop in the SP500 then at 1574. For those who went long the SP500 from the 20Dec2012 signal the trade generated a 10% return or more if leveraged with a 2X ETF such as RSU.

So the current NYSE Bullish Percent Index Chart signal is to go SHORT the SP500 Index. My trading stock to do this is SDS (ProShares SP500 2X Short) on the NYSE.

Currently I own this ETF and also own EUO which is a 2X short the EURO vs the US Dollar.

Remember these are short term trading positions and need to be closed to cut losses if the trade is not working.

Click to enlarge

Sunday, 14 April 2013

Sunday 14April2013 - Gold Market Action!

Well its been an exciting past week in the precious metals markets. Gold exploded to the downside when it broke below the US1527 dollar support shelf. As expected the break triggered a lot of stop loss sell orders.

The following Gold price chart is from Fridays EWI Short Term Financial update. The next downside target is the $1300 range around the bottom of wave 4 of wave (5). This would also be a 38% retracement of the advance from 1999.

EWI also noted that the inflation investments including gold, silver, oil and metals including DR Copper are all in decline. This would suggest that we are in a deflationary asset cycle which will eventually take its toll on the stock markets and Canadian real estate.

Perhaps Vancouver real estate is ripe for a major downward price correction. With many central Vancouver apartment condos held by so called investors but really speculators sitting with empty units (estimated at 25%) there could be a huge price crash when the speculators start to cut their losses and sell at any price in total disgust. And the current buyers of new condos for delivery several years from now will forfeit their deposits and walk away from their legal purchase obligations.

Well its been an exciting past week in the precious metals markets. Gold exploded to the downside when it broke below the US1527 dollar support shelf. As expected the break triggered a lot of stop loss sell orders.

The following Gold price chart is from Fridays EWI Short Term Financial update. The next downside target is the $1300 range around the bottom of wave 4 of wave (5). This would also be a 38% retracement of the advance from 1999.

EWI also noted that the inflation investments including gold, silver, oil and metals including DR Copper are all in decline. This would suggest that we are in a deflationary asset cycle which will eventually take its toll on the stock markets and Canadian real estate.

Perhaps Vancouver real estate is ripe for a major downward price correction. With many central Vancouver apartment condos held by so called investors but really speculators sitting with empty units (estimated at 25%) there could be a huge price crash when the speculators start to cut their losses and sell at any price in total disgust. And the current buyers of new condos for delivery several years from now will forfeit their deposits and walk away from their legal purchase obligations.

Wednesday, 3 April 2013

Wednesday 03April2013 - Market Action - Gold!

Gold continues to decline toward the $1527 support shelf where three previous declines found support in 2011 and 2012.

The BIG Question is - Will Gold again find support around $1527 or will it break down below the shelf this time?

If Gold breaks below $1527 it will most likely trigger many stop loss orders and result in a huge downward spike.

The following chart is from EWI 03April2013 Short Term Update.

Gold continues to decline toward the $1527 support shelf where three previous declines found support in 2011 and 2012.

The BIG Question is - Will Gold again find support around $1527 or will it break down below the shelf this time?

If Gold breaks below $1527 it will most likely trigger many stop loss orders and result in a huge downward spike.

The following chart is from EWI 03April2013 Short Term Update.

Subscribe to:

Comments (Atom)